Paddle vs. Chargebee: Which Billing Solution is Best for Your SaaS Business?

Table of contents

Quick Summary

This blog compares Paddle and Chargebee, two leading billing platforms for SaaS businesses, and introduces Boathouse as the ideal customer billing portal for Paddle. With extensive experience helping SaaS companies streamline their billing, we emphasize how choosing the right platform impacts revenue, customer satisfaction, and global compliance. Evaluate your business needs to decide between Paddle and Chargebee, and explore Boathouse to optimize your billing process.

Looking for the Right Billing Solution for your Saas Business?

Choosing the right billing solution is critical for the success of any SaaS business, as it directly impacts revenue management, customer satisfaction, and global compliance. Paddle and Chargebee are two leading platforms that offer robust features for handling subscriptions, payments, and invoicing.

However, the right choice depends on your business's specific needs. In this Boathouse guide, we’ll break down the key differences between Paddle and Chargebee to help you make an informed decision.

Why Listen to Us?

Paddle vs Chargebee: Which Platform Enhances Your Billing Experience

Paddle and Chargebee offer distinct solutions for subscription billing, each catering to different business needs. Paddle is an all-in-one platform with a Merchant of Record model, handling payments, global tax compliance, invoicing, and fraud prevention. It’s ideal for businesses looking for a simplified, hassle-free solution but comes with higher transaction fees and less flexibility in payment gateways.

Chargebee, on the other hand, is a highly customizable platform that supports complex billing models like usage-based or metered billing and gives businesses control over payment gateways. While it offers more flexibility and advanced financial features, it requires more setup and technical expertise to fully leverage.

What is Paddle?

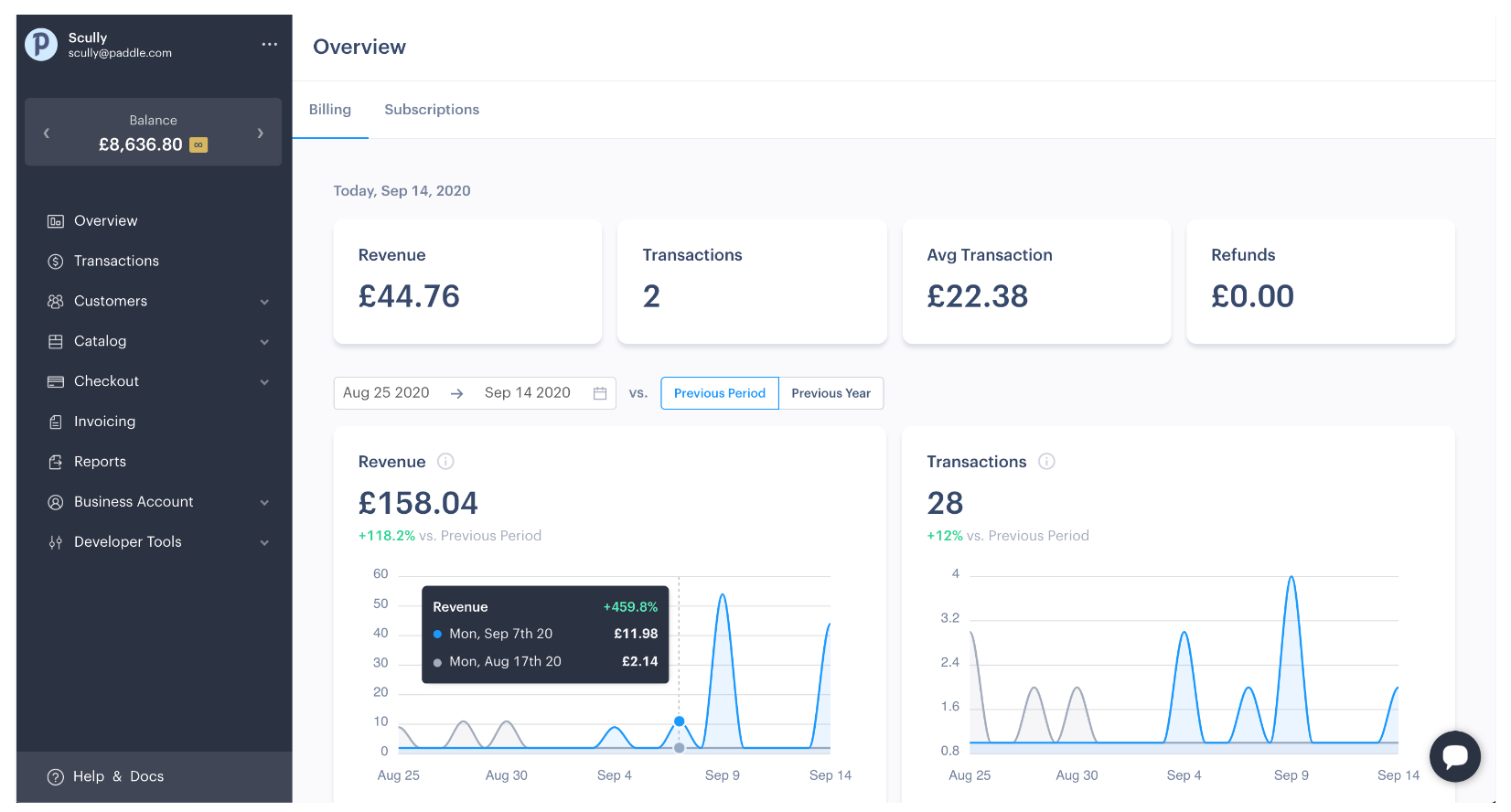

Paddle is a comprehensive billing platform designed for SaaS businesses. It simplifies subscription management, payment handling, and tax compliance, while offering tools to support your global growth.

Key Features

- Merchant of Record (MOR): Paddle takes responsibility for taxes, compliance, and global payments.

- Subscription Management: Provides flexible billing cycles, churn reduction tools, and trial management.

- Global Payments: Supports over 200 currencies and provides multi-currency transactions.

- Revenue Insights: Offers advanced analytics through ProfitWell.

- Licensing and Trials: Supports in-app purchases, trials, and licensing.

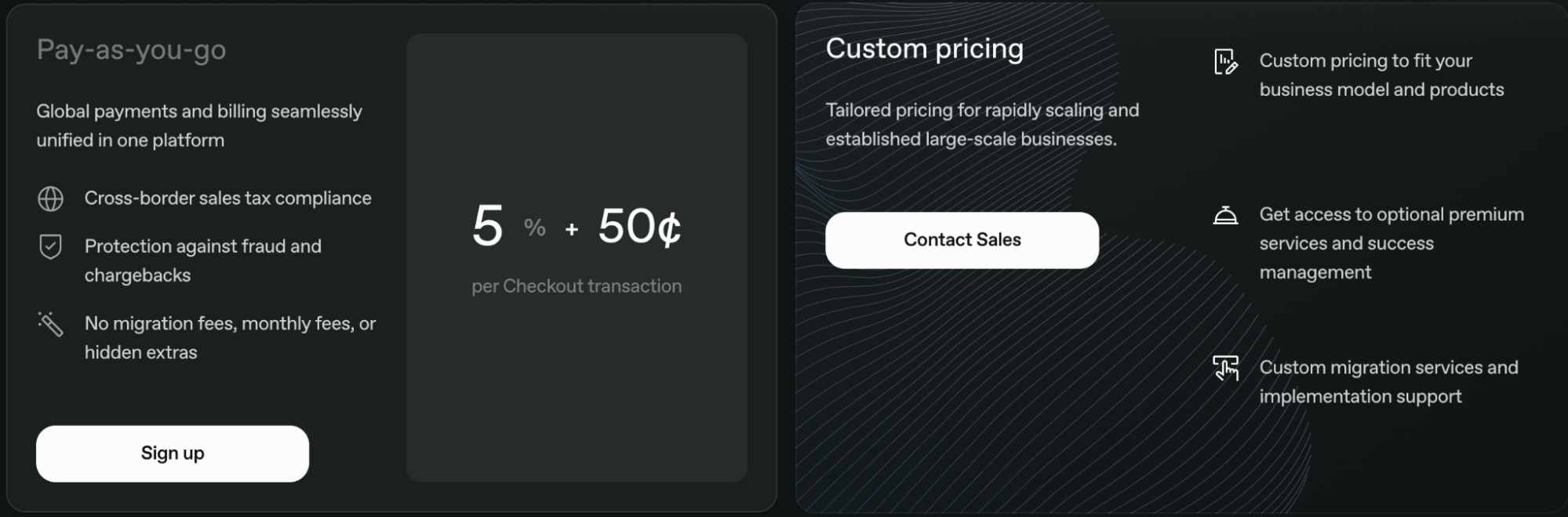

Pricing

Paddle follows a pay-as-you-go model, charging 5% + $0.50 per transaction, with custom pricing options available for larger enterprises. Most core services, such as subscription management, invoicing, and tax compliance, are included without additional fees, though some advanced features may incur extra costs.

Pros

- All-in-one solution for SaaS billing and revenue management.

- Automatically handles global compliance and tax regulations.

- Advanced subscription management and licensing tools.

Cons

- Transaction fees can accumulate quickly for smaller businesses.

- Setup may require a bit more time initially.

What is Chargebee?

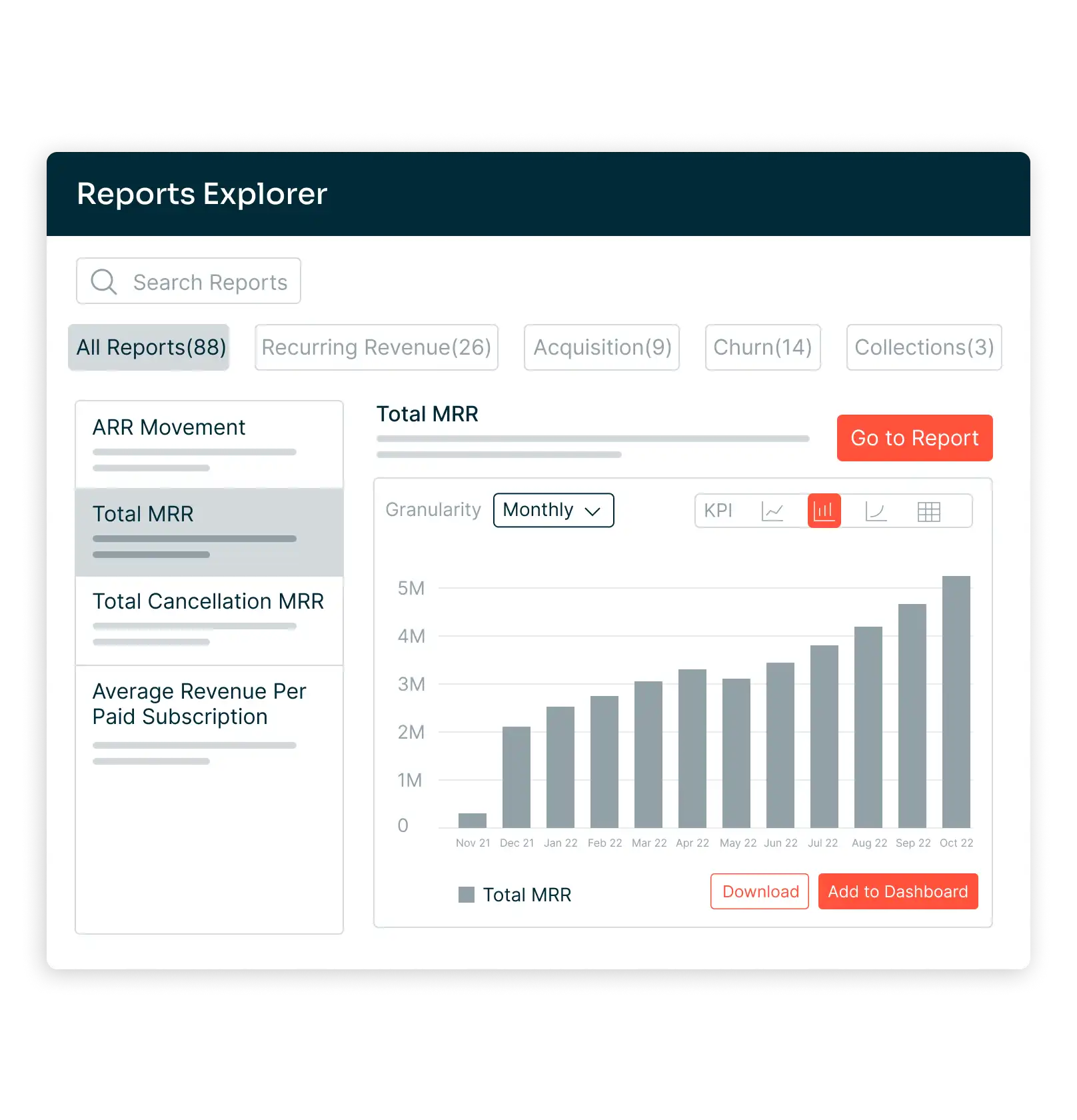

Chargebee is a subscription billing and revenue management platform built for SaaS businesses. It automates the recurring billing process, streamlines invoicing, and offers extensive customization options for complex pricing models.

Key Features

- Subscription Management: Manage multiple plans, upgrades, and downgrades with ease.

- Revenue Recognition: Automatically tracks revenue in accordance with GAAP standards.

- Global Compliance: Ensures compliance with various tax regulations like EU VAT and US sales tax.

- Automation: Streamlines billing, invoicing, and churn management.

- Integrations: Supports a wide array of integrations with CRM, accounting, and payment gateways.

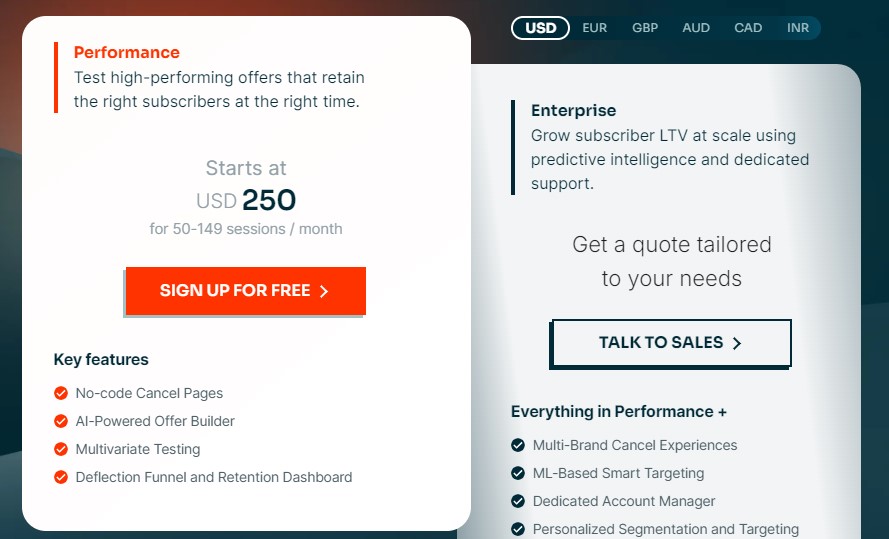

Pricing

Chargebee starts at $250/month for mid-market businesses, with a free plan available for companies generating less than $100K in revenue.

Pros

- High degree of customization for subscription management.

- Offers full automation for billing and invoicing workflows.

- Scalable solution for businesses of all sizes.

Cons

- Higher cost for growing companies.

- Requires more technical knowledge for configuration.

Feature Comparison: Paddle vs. Chargebee

| Feature | Paddle | Chargebee |

|---|---|---|

| Customer Billing Portal | Supported through Boathouse | Native but less customizable |

| Global Payments | 200+ currencies supported | Extensive multi-currency options |

| Subscription Management | Advanced tools, flexible billing | Highly customizable subscription models |

| Revenue Insights | ProfitWell analytics | Built-in revenue recognition |

| Automation | Basic automation | Full automation for billing and churn management |

| Tax Compliance | Global tax management, Merchant of Record | EU VAT, US sales tax, and more |

| Pricing | Pay-as-you-go (5% + $0.50/transaction) | Starts at $250/month |

| Scalability | Built for SaaS businesses of all sizes | Ideal for larger companies with complex needs |

| Ease of Use | Straightforward with Boathouse integration | Steep learning curve |

Choosing Between Paddle and Chargebee

- Paddle: If you're a SaaS business looking for a complete solution that handles payments, subscriptions, tax compliance, and offers an intuitive, branded customer billing portal, then Paddle is a great choice. The ability to provide customers with a self-service option significantly enhances customer satisfaction and minimizes support requests.

- Chargebee: If your business requires extensive customization and you have complex billing workflows, Chargebee offers unparalleled flexibility and automation. It's ideal for larger SaaS companies that need more control over subscription management and revenue recognition.

Introducing Boathouse: The Ideal Billing Portal for Paddle Users

While Paddle offers great subscription management and billing features, your customers’ experience can be greatly enhanced with a dedicated customer billing portal. This is where Boathouse comes in.

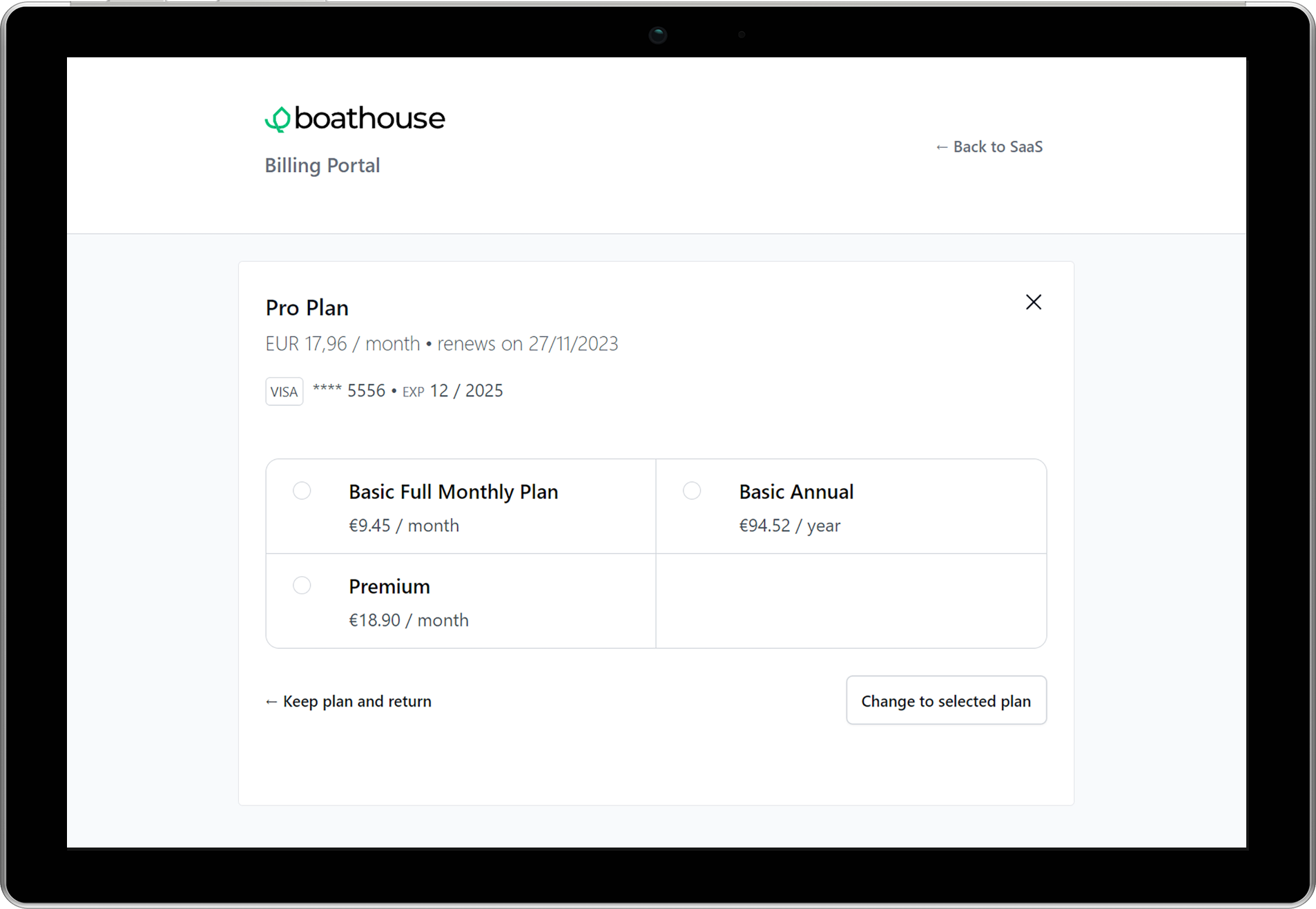

Boathouse is an easy-to-use, customizable billing portal designed specifically for Paddle users. It provides your customers with a self-service portal where they can manage their subscriptions, view invoices, update billing details, and access their payment history—all while integrating seamlessly with Paddle’s back-end features.

Key Features of Boathouse

- Self-Service Subscription Management: Customers can upgrade, downgrade, or cancel subscriptions on their own.

- Invoice and Payment History: Gives customers a clear view of their past transactions and billing details.

- Custom Branding: Align Boathouse with your brand, offering a consistent customer experience.

- Automated Communications: Automate invoicing, payment reminders, and subscription notifications.

Why Choose Boathouse with Paddle?

By adding Boathouse to your Paddle setup, you provide a more user-friendly, customer-centric billing experience. While Paddle manages the backend complexities like tax compliance and payment processing, Boathouse offers a clean, intuitive front-end portal that customers can easily navigate.

Benefits:

- Improves customer satisfaction with self-service capabilities.

- Reduces support queries related to billing.

- Enhances your brand image with a professional customer-facing portal.

- Streamlines customer interactions, making it easier for them to manage their accounts.

Conclusion

Choosing the right billing platform is crucial for SaaS businesses, and Paddle and Chargebee serve different needs. Paddle’s all-in-one Merchant of Record model simplifies payments, tax compliance, and fraud prevention, making it ideal for those seeking a hassle-free solution. Chargebee offers more customization but requires more technical expertise.

At Boathouse, we specialize in building custom billing portals for SaaS founders using Paddle. Our expertise helps streamline billing, so you can focus on growing your business.

Experience Boathouse with a free customer portal or book a demo today!