Unveiling Paddle's Payment Routing: Boost Your Revenue Without Extra Work

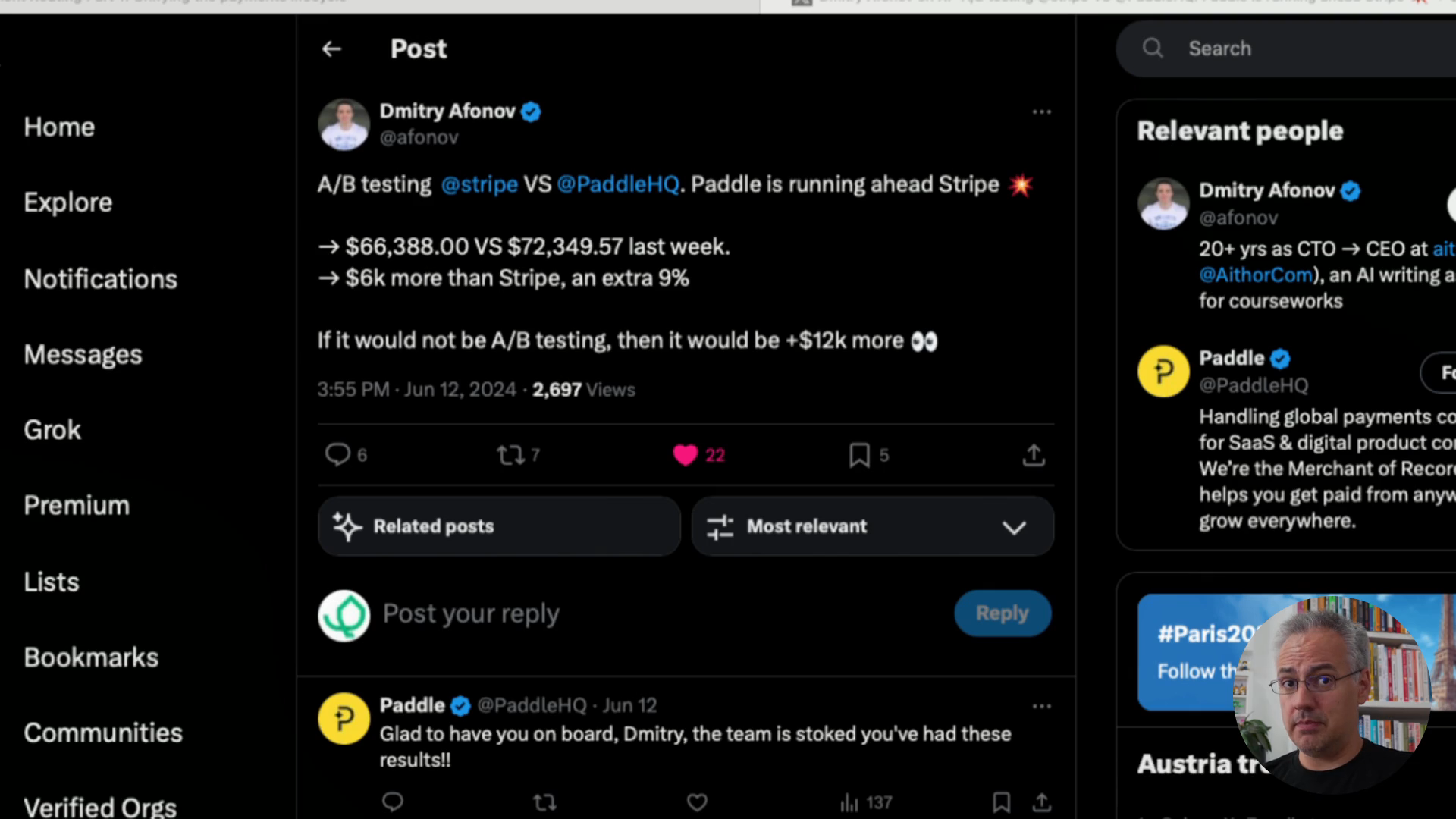

Hi, I'm Alex, and welcome back to the Boathouse paddle series where we dive deep into everything concerning Paddle. Today, I want to reveal an interesting aspect of Paddle that might not be immediately obvious. This insight was sparked by a tweet from Ditri, who conducted an A/B test comparing different payment providers.

A Remarkable Discovery Through A/B Testing

Ditri's test pitted Stripe, a well-known credit card provider, against Paddle. Interestingly, the test showed that Paddle generated 9% more revenue compared to Stripe. This comparison isn’t about the usual reasons for choosing Paddle, like being a merchant of record and handling taxes for you (whereas with Stripe, you do that yourself).

This is purely about revenue. How does Paddle achieve this? The secret lies in Paddle’s sophisticated use of payment service providers.

Payment Routing: How Paddle Optimizes Your Revenue

Paddle isn't just using Stripe under the hood for credit card payments like many other merchant-of-record services.

A Fleet of Payment Providers

Paddle works with a whole fleet of payment service providers. They choose the best one tailored to each target customer, which can result in higher revenue, as demonstrated by Ditri's test. This dynamic selection isn’t just about finding the best deals.

Key Benefits:

- Increased Revenue: As the test shows, Paddle's payment routing can lead to more revenue.

- Payment Method Availability: Paddle can integrate country-specific payment methods that might be missing from other services like Stripe.

Adaptive and Flexible Payment Methods

Paddle's flexibility allows it to accept various payments through different methods. For instance, if a local payment provider in a specific country supports a payment method that Stripe doesn’t, Paddle can integrate with that provider, making it possible for your SaaS to accept such payments.

Example: If you’re targeting customers in a country where a local payment service is preferred, Paddle ensures you can accept payments through that service, something Stripe might not offer.

Detailed Insights from Paddle's Blog

For those interested in the nitty-gritty details, Paddle has published an informative two-part series on payment routing on their blog. It’s a great read to understand how they choose providers and how the entire system works under the hood.

Read Part One of Paddle's Payment Routing Blog

Read Part Two of Paddle's Payment Routing Blog

Visual Breakdown of Payment Routing

Despite storing the payment method, Paddle dynamically chooses the right payment service provider, ensuring the payment is successful and credited to your account. This behind-the-scenes switching guarantees that the best option is always utilized.

Ensuring Success: Failover Mechanism

A significant aspect of Paddle’s system is its failover mechanism. If a payment method fails, Paddle can switch to another provider seamlessly, ensuring higher success rates and minimizing failed transactions.

Why Paddle’s Revenue Boost Matters

9% might not seem huge at first glance, but consider this in terms of revenue:

Example Calculation:

- If your monthly revenue through Stripe is $100,000...

- Switching to Paddle could potentially increase this to $109,000.

This enhancement directly impacts your bottom line, making Paddle a worthy consideration for scaling your SaaS business.

Conclusion

Choosing the right payment service provider can influence more than just how you get paid. As seen through Ditri’s test, Paddle’s unique approach to payment routing can lead to a significant boost in revenue. By dynamically selecting and switching between multiple providers, ensuring local payment methods, and handling payment failures efficiently, Paddle can offer more than just convenience—it can provide a tangible impact on your business's financial health.

That’s it for today’s exploration! Stay tuned for more insights from our Boathouse paddle series.