Understanding the Revenue Recognition Principle for SaaS Businesses

Table of contents

Quick Summary

Revenue recognition ensures that SaaS businesses accurately report income as services are delivered. Boathouse, specializing in SaaS accounting, helps companies stay compliant while optimizing revenue management. By automating deferred revenue, setting clear subscription plans, and tracking billing changes, businesses can build trust, maintain compliance, and reflect true performance. Learn more about how Saas billing tools like Boathouse simplify revenue recognition processes.

Revenue Recognition for SaaS Companies

The revenue recognition principle is crucial for SaaS companies that operate on subscription models. It dictates when revenue should be recognized—based on when services are delivered, not when payments are received. Given the complexity of subscription billing and variable cycles, accurate revenue recognition is essential for maintaining financial transparency and compliance.

In this Boathouse article, we'll explore why this principle is particularly important for SaaS businesses and how tools like Boathouse can help automate the process, ensuring accurate reporting and reducing manual effort.

Why Listen to Us?

What is the Revenue Recognition Principle?

The revenue recognition principle dictates when a company should record its revenue. In simple terms, it states that revenue should be recognized when it is earned, not necessarily when payment is received. This distinction is crucial because it ensures that a company's financial statements accurately reflect its financial performance over time.

Under generally accepted accounting principles (GAAP), revenue is typically recognized when:

- Goods or services have been delivered: The customer has received what they’ve paid for.

- There is clear evidence of an arrangement: A contract or agreement exists between the business and the customer.

- The price is fixed or determinable: The amount to be paid for the product or service is fixed or can be reasonably estimated.

- Payment is reasonably assured: The customer is expected to pay for the service or product delivered.

This method contrasts with cash basis accounting, which recognizes revenue only when payment is received, and may not reflect the company's actual performance.

Why is the Revenue Recognition Principle Important?

For SaaS businesses, especially those using subscription models, recognizing revenue accurately is crucial. It prevents overstating or understating revenue by ensuring that income is spread over the duration of the subscription, reflecting the service's delivery.

Key benefits of proper revenue recognition include:

- Financial Transparency: It gives a clear picture of how much revenue the business has truly earned over a specific period.

- Compliance: Following the revenue recognition principle is a requirement under GAAP and International Financial Reporting Standards (IFRS), which most investors and regulatory bodies follow.

- Investor Confidence: Transparent revenue reporting helps maintain the trust of investors, who rely on accurate financial statements for decision-making.

Now that we understand the basics, let's explore how this principle applies specifically to SaaS businesses.

Revenue Recognition for SaaS Companies

SaaS businesses deliver services over time, and therefore revenue must be recognized incrementally, aligned with service delivery. Let's explore how this applies:

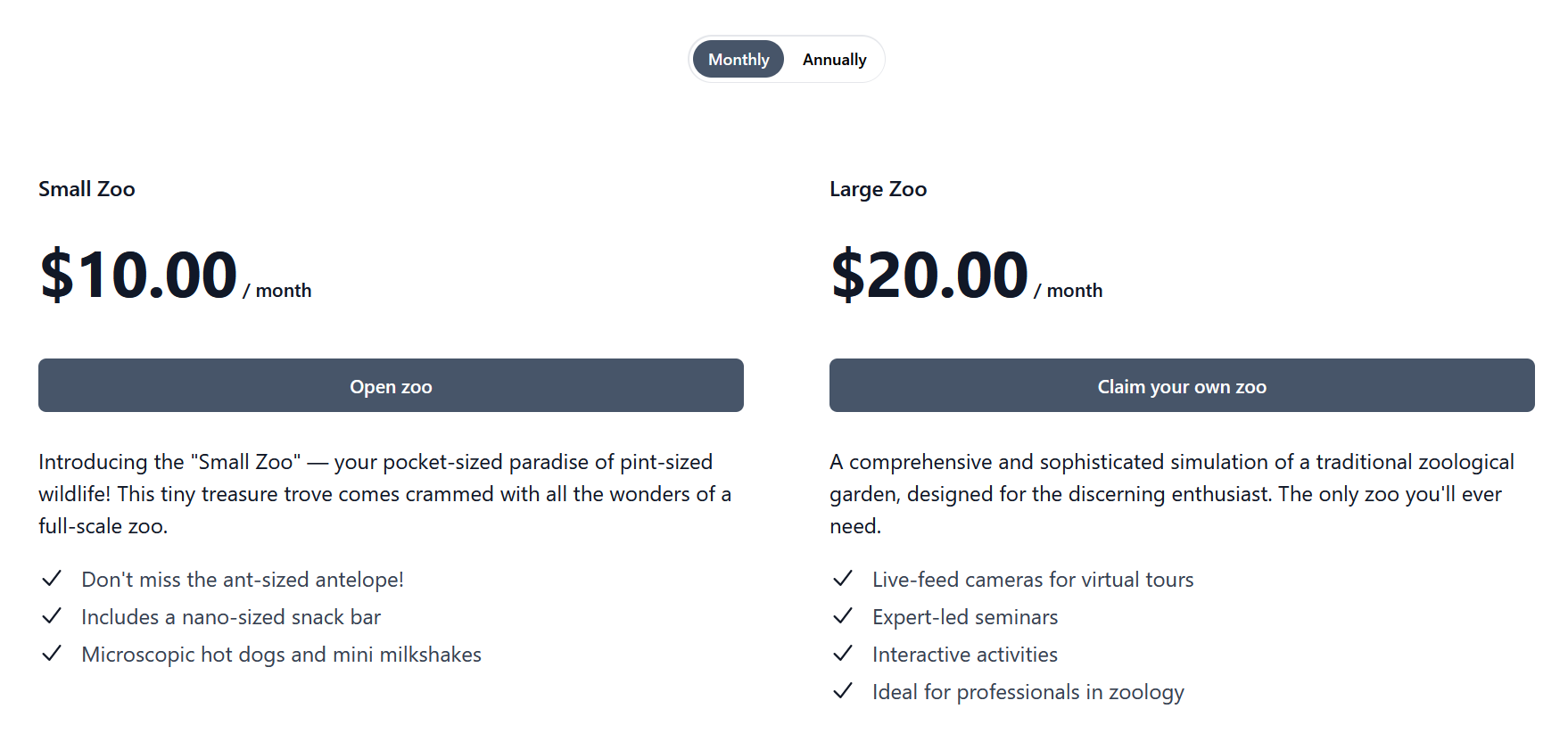

Most SaaS businesses operate on a subscription basis, where customers pay for access to software over a period of time (e.g., monthly, quarterly, annually). Under the revenue recognition principle, revenue must be recognized over the life of the subscription, not when the customer pays.

For example, if a customer pays $1,200 upfront for an annual subscription, the SaaS company can’t record the entire $1,200 as revenue at the time of payment. Instead, they recognize $100 in revenue each month, reflecting the period during which the service is delivered.

For SaaS businesses, upfront payments result in deferred revenue, which refers to payments received for services that have not yet been provided. Deferred revenue is considered a liability on the balance sheet until the service is delivered, at which point it is recognized as earned revenue.

SaaS businesses often offer a combination of products and services, such as software access bundled with customer support or onboarding services. Each of these elements may have different revenue recognition criteria. For example, the software portion may be recognized over the subscription term, while a one-time setup fee could be recognized when the setup is complete.

Accurate revenue recognition in multi-element arrangements requires clear allocation of the total contract price to each element based on its fair value. This process is known as allocating transaction price under the new ASC 606 standard, which applies to revenue from contracts with customers.

Challenges in Revenue Recognition for SaaS Companies

SaaS companies face several challenges in revenue recognition:

- Complex Subscription Models: Varying plan durations and features make it difficult to allocate revenue across periods accurately.

- Discounts and Free Trials: Discounts lower transaction prices, affecting revenue spread, while free trials involve recognizing no revenue during the trial period.

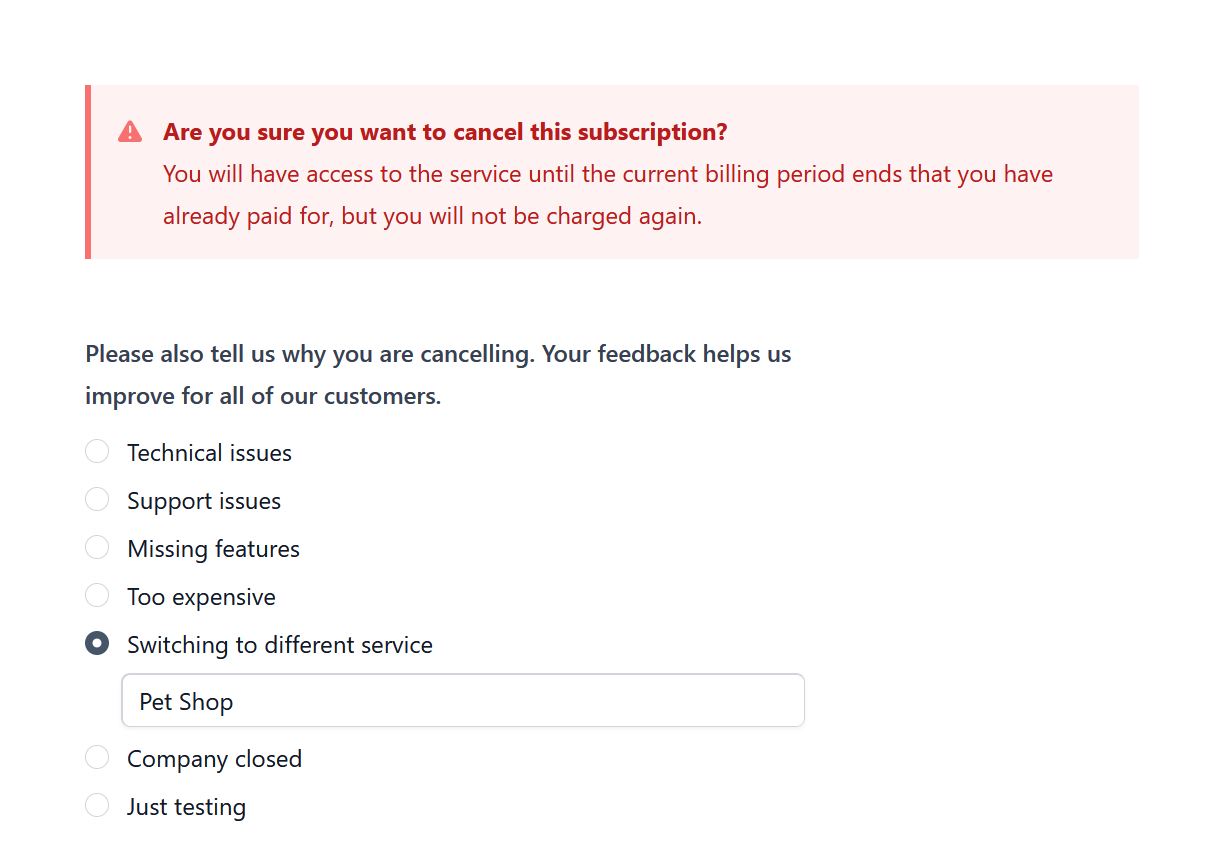

- Upgrades, Downgrades, and Cancellations: Mid-term plan changes complicate how to adjust revenue based on contract modifications or new agreements.

- Global Customers: Different currencies, taxes, and revenue rules across regions add further complexity to recognizing revenue correctly.

How Boathouse Simplifies Revenue Recognition for SaaS Companies

As we’ve explored, revenue recognition is a critical but complex area for SaaS businesses. This is where tools like Boathouse come in to save time and effort by streamlining billing and subscription management, ensuring compliance with revenue recognition principles. Here’s how Boathouse can help:

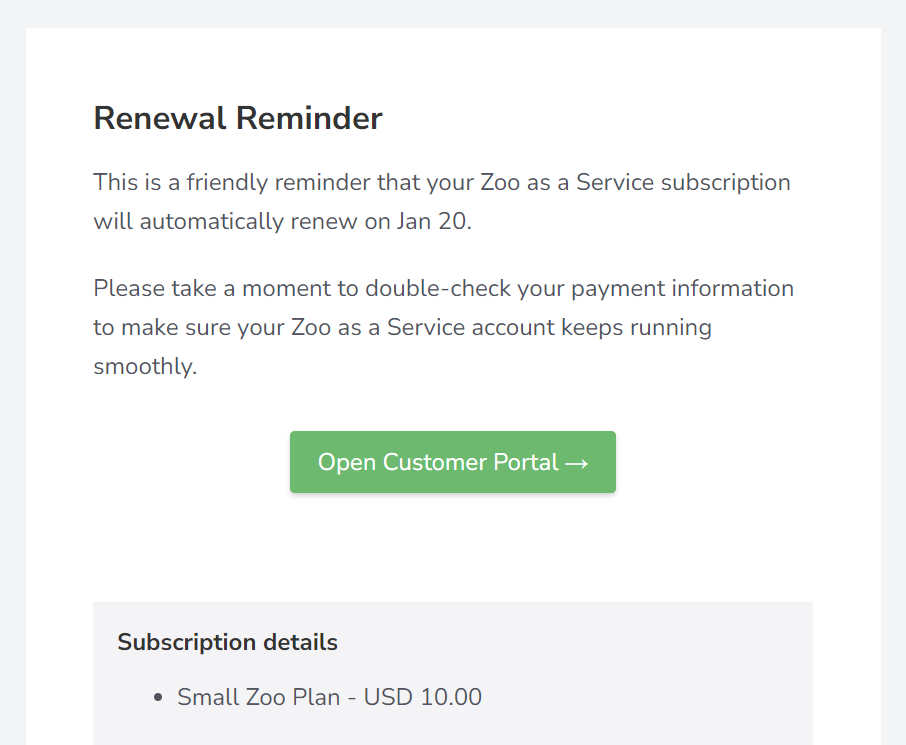

Boathouse offers a self-service billing portal that allows SaaS businesses to manage subscriptions, track customer payments, and ensure that billing aligns with revenue recognition standards. This portal can be customized to fit your brand, offering a seamless experience for your customers while giving you full control over your billing processes.

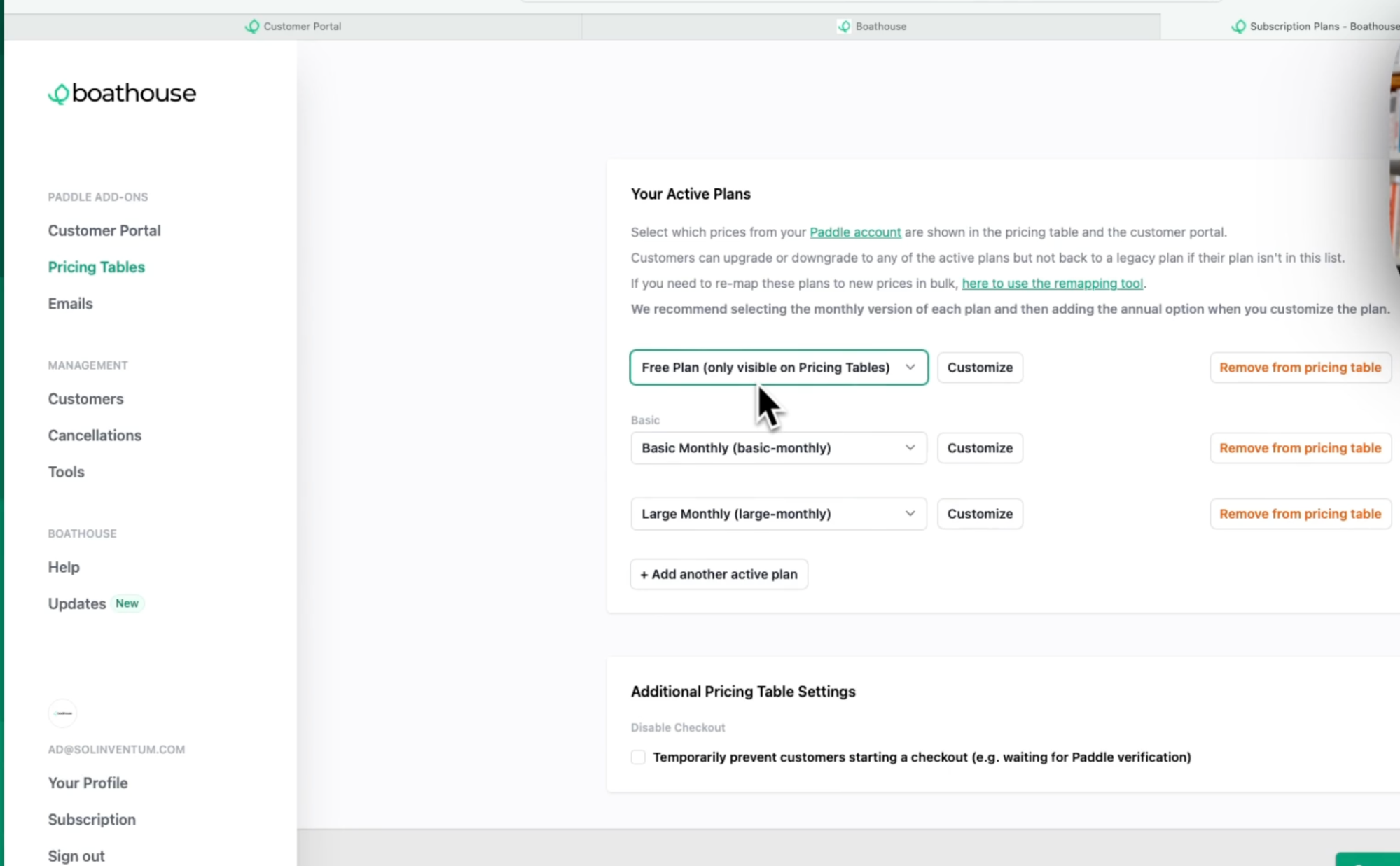

Boathouse provides embeddable pricing tables that can be integrated directly into your website, allowing you to offer customers transparent and easy-to-understand pricing information. This feature simplifies the process of tracking customer subscriptions and managing deferred revenue, ensuring that revenue is recognized at the right time.

If your SaaS business serves a global customer base, Boathouse’s localized billing support automatically detects and supports up to 20 languages. This ensures that your billing processes remain compliant with local accounting rules, making revenue recognition across borders easier and more accurate.

Boathouse offers customizable cancellation flows that let you collect feedback from customers when they cancel their subscription. This helps you adjust your revenue recognition process to accurately reflect the remaining subscription period, ensuring proper management of deferred revenue.

Boathouse integrates with ProfitWell Retain, a customer retention tool that manages cancellations and retention efforts. This integration ensures that your revenue recognition stays on track even when customer accounts change, such as when they renew, downgrade, or cancel their subscriptions.

Boathouse ensures that your customers' data is securely handled, maintaining compliance with privacy standards. This not only helps build customer trust but also ensures that all billing and subscription information is accurate and protected, which is crucial for proper revenue recognition.

Boathouse's simple HTTP POST API allows for quick and easy integration with your existing tech stack, enabling you to automate many aspects of billing and revenue recognition. This automation reduces the risk of manual errors, ensuring compliance with accounting standards like ASC 606.

How to Implement a Revenue Recognition Process with Boathouse?

Implementing a proper revenue recognition process is critical to staying compliant and ensuring that your SaaS business can scale without running into financial issues. Here’s how you can use Boathouse to streamline this process:

- Set Up Your Subscription Plans: Use Boathouse’s embeddable pricing tables to create clear, transparent pricing models that align with revenue recognition standards. Make sure each subscription plan is tied to a specific revenue recognition schedule.

- Automate Deferred Revenue Tracking: Boathouse's customizable billing portal can track payments and automatically record deferred revenue for any upfront payments. This ensures that revenue is recognized in the correct period.

- Monitor Cancellations and Modifications: Use Boathouse’s cancellation flows and ProfitWell Retain integration to monitor changes to customer accounts. Ensure that modifications to subscription plans are accurately reflected in your revenue recognition process.

- Generate Financial Reports: Boathouse allows you to generate detailed reports on customer billing, deferred revenue, and recognized revenue, giving you a clear view of your company’s financial health.

- Ensure Global Compliance: With Boathouse’s localized billing support, you can serve a global audience while ensuring that your revenue recognition process complies with the relevant accounting standards in each region.

Mastering Revenue Recognition for Sustainable Growth

The revenue recognition principle is a cornerstone of accurate financial reporting for SaaS businesses, and it’s especially important for companies that operate on a subscription-based model. By ensuring that revenue is recognized when it is earned—not when payment is received—SaaS businesses can provide a clear picture of their financial performance to stakeholders, maintain investor confidence, and comply with accounting standards.

For SaaS businesses using Paddle billing, Boathouse offers an all-in-one solution to manage billing, subscriptions, and revenue recognition with ease. From customizable billing portals and embeddable pricing tables to seamless integration with retention tools, Boathouse helps SaaS businesses streamline their operations and focus on what truly matters.

Ready to streamline your billing processes and ensure compliance? Get started with Boathouse today!