Remittance Advice: A Complete Guide for SaaS Businesses

Table of contents

Quick Summary

Remittance advice confirms payment details between buyers and suppliers, ensuring smoother financial transactions. With expertise in SaaS billing and financial workflows, we provide proven solutions to manage remittance advice efficiently. Proper management helps avoid disputes, ensures accurate records, and improves cash flow. Automate processes with tools like Boathouse for greater accuracy and time savings.

Why Remittance Advice Matters for Your Business

Remittance advice is a crucial yet often overlooked component of the payment process in business transactions. Whether you are running a small business or managing a larger enterprise, understanding remittance advice can streamline your payment processes, improve communication between trading partners, and ensure accurate record-keeping. This blog will explain what remittance advice is, its types, importance, and best practices for using it effectively.

We'll also introduce Boathouse, our billing management platform that simplifies the handling of remittance advice and other financial documentation, especially for SaaS businesses using Paddle.

Why Listen to Us?

What Is Remittance Advice?

Remittance advice is a document sent by a buyer to a supplier or vendor, notifying them that a payment has been made for a specific invoice or group of invoices. It serves as a communication tool to ensure that the payment details are clear, particularly regarding which invoices are being paid and any discrepancies that might exist.

While remittance advice rarely requires a response from the recipient, it ensures transparency in the payment process and helps both parties keep their accounting records accurate and up-to-date.

Types of Remittance Advice

-

Basic Remittance Advice:

This is a simple notice that informs the recipient of the payment made and the invoice(s) it covers. It’s commonly used when there are no disputes or special conditions attached to the payment.For example, if a small business owner pays a supplier $1,000 for a recent order of office supplies. The remittance advice simply states the payment amount of $1,000 and the invoice number (INV-12345). The supplier receives the payment and can easily match it to the corresponding invoice.

-

Detailed Remittance Advice:

Provides a more comprehensive breakdown of the payment, including specifics like the payment method, the invoices paid, any discounts applied, and deductions made (if applicable).If, for instance, a company makes a payment of $5,000 to a supplier covering multiple invoices. The detailed remittance advice includes a breakdown: $2,000 for Invoice INV-1001, $1,500 for INV-1002, $1,000 for INV-1003, and $500 in early payment discounts. The supplier verifies which invoices have been paid and any discounts applied.

-

Partial Payment Remittance Advice:

This type of advice is used when a buyer makes a partial payment on an invoice, indicating the portion of the invoice that has been settled and outlining the remaining balance.When a buyer owes a supplier $3,000 for an order of equipment, but can only make a partial payment of $1,500 at the moment. The partial payment remittance advice clearly states the payment of $1,500, specifies the remaining balance of $1,500, and references the original invoice. This ensures transparency about the outstanding amount.

-

Scannable Remittance Advice:

Some businesses use remittance advice that can be scanned and automatically processed by the supplier’s accounting system, reducing manual work and improving accuracy.A large corporation uses automated invoicing and payment systems. After making a payment of $10,000, the company sends a scannable remittance advice that includes a QR code or barcodes that the supplier’s accounting system can scan to automatically update their records. This minimizes human error and accelerates the reconciliation process.

Why Is Remittance Advice Important?

Remittance advice ensures that payments are correctly allocated and reconciled, playing an essential role. Its significance goes beyond simply informing a supplier that a payment has been made. Here’s why remittance advice is crucial for businesses:

- Accurate Payment Tracking: Remittance advice provides clarity on which invoices have been paid, preventing confusion or misallocation of payments. This is particularly useful when multiple invoices are being processed at the same time.

- Improved Communication: Sending remittance advice fosters open communication between the buyer and supplier, helping to avoid disputes or misunderstandings about payments.

- Facilitating Reconciliation: For suppliers, remittance advice helps ensure that payments received are correctly applied to the corresponding invoices. It simplifies the reconciliation process and helps maintain accurate financial records.

- Compliance and Audit Trails: Businesses need accurate documentation for auditing and compliance purposes. Remittance advice offers a clear paper trail, helping businesses meet regulatory requirements and providing proof of payment in case of disputes.

- Cash Flow Management: Remittance advice helps both parties manage their cash flow better by clearly indicating when and how much has been paid. This transparency is key to avoiding cash flow issues and maintaining healthy business relationships.

Key Components of a Remittance Advice

While remittance advice documents can vary, certain key components are essential for ensuring clarity and accuracy. These include:

- Payment Date: The date the payment was made.

- Payment Amount: The total amount of money transferred.

- Invoice Numbers: A list of the invoice(s) the payment is covering.

- Purchase Order Numbers: If applicable, the relevant purchase order number(s).

- Payment Method: The method of payment (e.g., bank transfer, credit card, etc.).

- Discounts or Adjustments: Any discounts applied or adjustments made to the invoice(s).

- Deductions: If applicable, a breakdown of any deductions made from the payment.

Including all relevant information ensures that both the buyer and supplier are on the same page regarding the payment details.

Best Practices for Handling Remittance Advice

To ensure that remittance advice is used effectively in your business, here are some best practices to follow:

-

Automate Where Possible

Using billing software that automatically generates remittance advice can save time and reduce errors. Platforms like Boathouse help SaaS businesses automate payment processes, including the generation and tracking of remittance advice.

-

Include All Necessary Details

Always ensure that your remittance advice includes all essential information, such as invoice numbers, payment amounts, and any adjustments made. Clear and detailed remittance advice reduces the chances of errors in payment allocation.

-

Keep a Record

Both buyers and suppliers should keep copies of all remittance advice for their records. This can be particularly useful in case of disputes or audits.

-

Provide Timely Remittance Advice

Send remittance advice promptly after making a payment. This keeps the supplier informed and prevents confusion regarding the status of the invoice.

-

Use a Standard Format

While there is no universal format for remittance advice, using a standard format within your organization makes it easier for all parties to understand and process the information efficiently.

Digital Remittance Advice: The Future of Payment Communication

Many businesses are shifting to electronic remittance advice. This offers several benefits over traditional paper-based methods:

- Faster Processing: Digital remittance advice can be sent and received instantly, speeding up the reconciliation process.

- Reduced Errors: Automated digital systems reduce the risk of human error in generating and processing remittance advice.

- Cost-Effective: Digital remittance advice reduces the costs associated with printing and mailing paper documents.

- Environmentally Friendly: By moving away from paper-based systems, businesses can reduce their environmental impact.

Tools like Boathouse provide SaaS businesses with digital solutions for handling remittance advice, automating the entire payment process from billing to reconciliation.

How Boathouse Simplifies Remittance Advice for SaaS Businesses

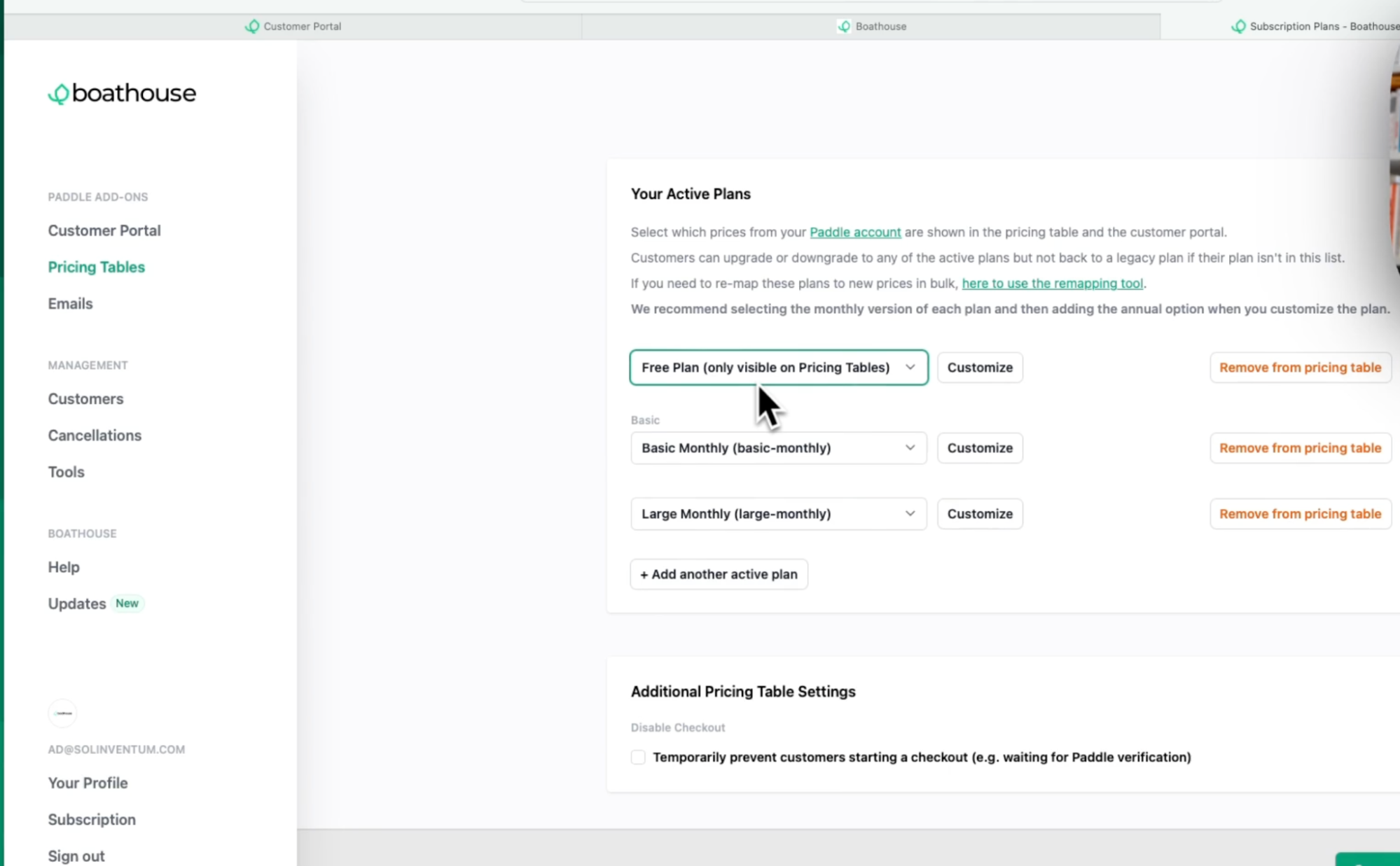

For SaaS businesses using Paddle for billing, Boathouse offers an all-in-one platform that automates the management of billing and remittance advice. Boathouse integrates seamlessly with your payment processes, allowing you to:

- Automatically generate remittance advice for all payments, ensuring accurate and timely communication with suppliers.

- Customize billing portals and provide transparency to your clients, reducing the potential for payment disputes.

- Track and reconcile payments easily, with a built-in dashboard that keeps all payment information in one place.

![]()

- Manage global customers and handle remittance advice across multiple currencies and languages, thanks to its global billing support.

By simplifying the process of sending and tracking remittance advice, Boathouse helps SaaS businesses focus on growth without getting bogged down in administrative tasks.

Optimize Your Payment Process with Effective Remittance Advice

Remittance advice plays a critical role in ensuring transparent and accurate payment processes. Whether you’re managing a small business or a large enterprise, implementing best practices for remittance advice can improve communication with suppliers, streamline reconciliation, and ensure compliance with financial regulations.

For SaaS businesses looking to automate and optimize their payment processes, Boathouse offers a comprehensive solution. From billing to remittance advice, Boathouse helps businesses stay organized, reduce manual work, and enhance the efficiency of their financial operations.

Ready to streamline your payment process? Start using Boathouse today!