What Is a Merchant of Record? Everything You Should Know

Table of contents

Quick Summary

This article explains what a Merchant of Record (MoR) is and why it's crucial for online businesses. It covers how MoRs handle payment processing, taxes, compliance, and customer support. Learn how to choose the right MoR for your business and find out why Boathouse can help you reduce risk while improving customer experience.

Looking To Understand The Importance of a MoR?

Ever wondered what keeps your online transactions running smoothly? If you’re managing an online business, you’ve likely encountered the term “Merchant of Record” (MoR).

While it may sound formal, understanding how a Merchant of Record works reveals the essential role it plays in ecommerce. From payment processing to managing tax compliance, an MoR lets you focus on your core business without getting bogged down by complex financial details.

In this Boathouse article, we’ll break down what a Merchant of Record is, why it matters, and how to pick the right one for your online sales. Whether you’re new to this or just looking for a refresher, you’ll walk away with a clear understanding of how an MoR can simplify your operations.

Why Listen to Us?

What is a Merchant of Record?

A Merchant of Record is a service provider responsible for managing all aspects of financial transactions on behalf of a business. This includes payment processing, tax management, compliance, refunds, and chargebacks.

Essentially, the MoR assumes legal responsibility for the transaction, acting as the seller in the eyes of the payment processor.

The MoR’s duties cover a wide range of financial and legal tasks. Here are the key tasks they take care of:

- Handling payment processor fees

- Sales tax and VAT compliance

- Sending and managing billing emails

- Applying fraud detection and prevention measures

- Maintaining PCI compliance for secure transactions

- Regulatory compliance beyond PCI

- Chargebacks and disputes

- Providing reporting and analytics

- Converting currencies for global transactions (check out our clean pricing converter)

How does the Merchant of Record model work?

The Merchant of Record model positions the MoR as the legal seller of a product or service, even if the transaction takes place on your website. When a customer completes a purchase, the MoR’s name appears on their financial statement. They become the primary point of contact for any payment-related issues, managing the financial and legal side of the transaction on your behalf.

Here’s how the process typically works:

- Customer purchase: When a customer purchases from your online store, the MoR processes payment through its own payment infrastructure.

- Payment processing and tax handling: The MoR, Paddle billing for instance, processes the payment through integrated gateways like credit cards, PayPal, and digital wallets. They also calculate and manage sales tax, VAT, and other required fees.

- Transaction confirmation: Transaction receipts and billing emails are sent to customers by the MoR.

- Compliance and legal requirements: The MoR ensures the transaction complies with local tax laws, regulations, and fraud prevention measures. They also handle legal documentation.

- Customer relations and refunds: Should any disputes such as chargebacks arise, the MoR represents the merchant’s interests, manages documentation, and processes refunds or returns as necessary.

In short, the MoR does the heavy lifting when it comes to the financial and legal aspects of eCommerce transactions, particularly when it comes to operating internationally.

Why is a Merchant of Record important?

A Merchant of Record plays a vital role in simplifying global ecommerce operations. Let’s explore the key reasons why having an MoR can be transformational:

Simplifies global compliance

Compliance with local tax laws and regulations can be one of the most daunting aspects of global eCommerce. Every country has its own set of rules when it comes to VAT, sales tax, and other regulatory requirements. An MoR takes care of all of this for you, ensuring compliance in every region you operate in.

With an MoR, you can offer localized pricing, currencies, and payment options from day one. For example, Boathouse, through Paddle, simplifies tax compliance across multiple countries, offering seamless localization to improve the overall customer experience.

For more information about managing international pricing, check out our article “Setting clean prices for international markets using Paddle.”

Reduces financial risk

Every country has its own set of changing regulations, which can make compliance not only difficult but risky. If you miscalculate taxes or overlook a regulation, you could be facing hefty legal penalties. A Merchant of Record mitigates this risk by keeping your business compliant with all applicable regulations and managing the associated paperwork.

Moreover, an MoR reduces financial risk by handling disputes, refunds, chargebacks, and fraud prevention. You’re no longer solely responsible for managing these potentially time-consuming tasks.

Streamlines payment processing

An MoR handles all aspects of payment processing, so you don’t have to manage relationships with multiple payment providers. They take care of everything from processing credit card transactions to handling customer refunds.

This consolidation simplifies your operations. Instead of juggling multiple vendors for payment processing, tax compliance, and customer relations, you work directly with one entity—the MoR.

Cost-effective

Managing global payments, taxes, and compliance independently is costly. Building your own infrastructure for these tasks can require significant upfront investment, not to mention the ongoing costs of maintaining compliance as regulations evolve.

Partnering with an MoR is a more cost-effective alternative. They already have the necessary systems in place, which can save you a significant amount of money compared to developing your own solution.

Improves customer experience

An MoR allows you to offer a smoother, more consistent customer experience. Your clients can pay using their preferred methods, view prices in their local currency, and benefit from hassle-free transactions. Plus, if they encounter any payment issues, the MoR handles customer service, further enhancing the buying experience.

By providing a localized, straightforward experience, MoRs build customer trust and encourage repeat business.

Now that we’ve explored why they’re important, let's look at how to choose the right one for your business.

How to Choose a Merchant of Record

Choosing the right Merchant of Record (MoR) can make or break your ecommerce operations. Here are some factors to consider when making your decision:

Global reach and payment capabilities

If you plan to expand internationally, make sure your MoR supports multiple currencies, payment methods, and country-specific payment options.

A good MoR will also provide seamless localization, ensuring each customer enjoys customized checkout optimization based on their location.

Compliance expertise

Keeping up with ever-changing regulations is challenging, especially if you’re expanding into new regions. A dependable MoR should have a strong grasp of global compliance, including tax laws, data privacy regulations, and consumer protection standards.

They should manage the complexities of sales tax and local legislation in all relevant markets, saving your business from potential fines and headaches down the line.

Transparent pricing

MoR pricing structures vary. Some charge a flat fee, while others take a percentage of every transaction. It’s important to understand what’s included in their pricing—check for additional costs for things like transaction processing, compliance, or fraud prevention—so there are no surprises.

Look for a MoR that offers transparent pricing that matches your business goals.

For more information, feel free to refer to our article, “Paddle vs. Stripe: Which Billing Solution Is Better for You?” to explore varying pricing options available.

Integration with your existing systems

Consider how easily the MoR integrates with your existing infrastructure. Whether it’s your billing system, customer portal, or website, an ideal MoR will complement your current setup without requiring a full system overhaul.

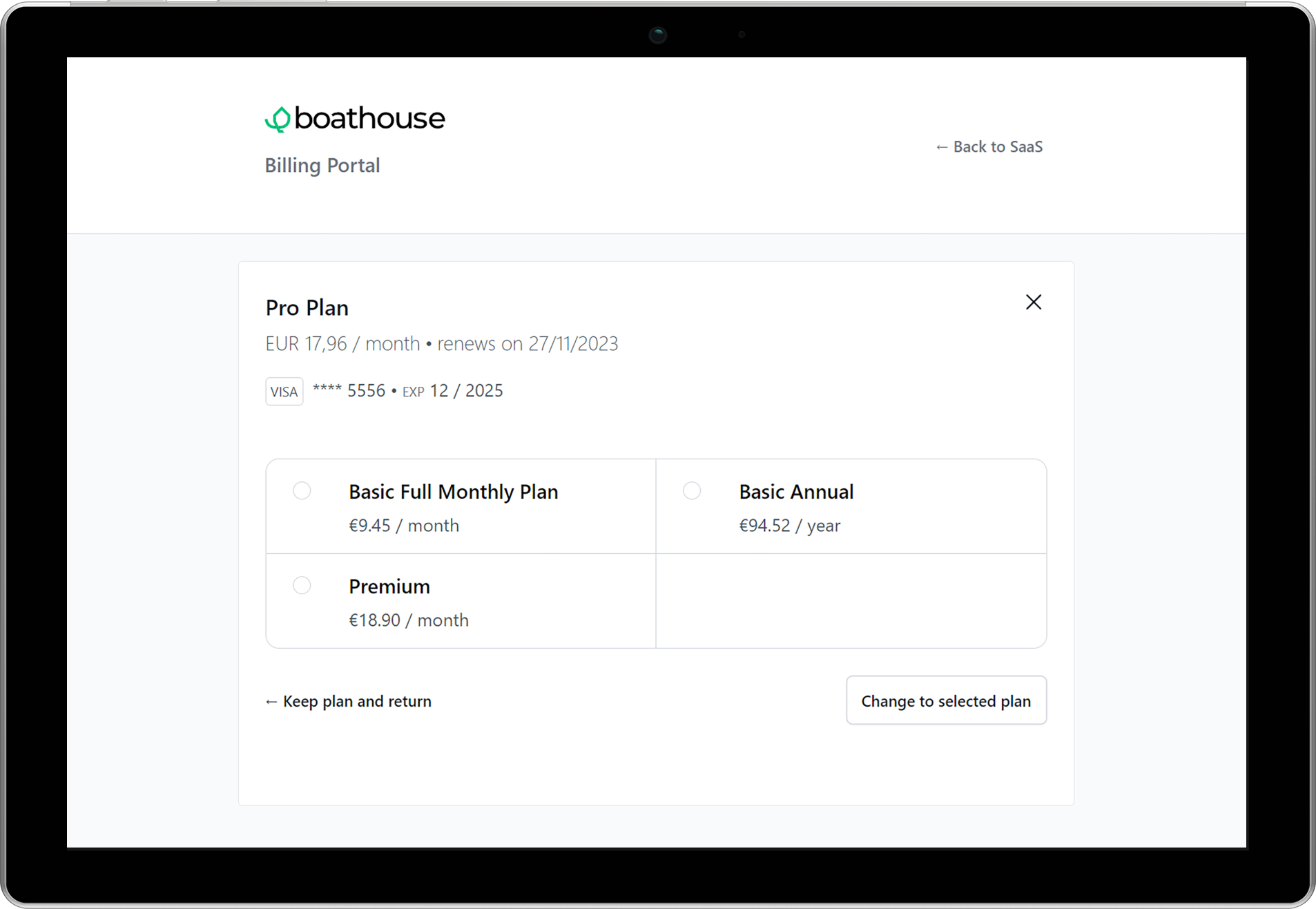

Boathouse works with Paddle as its MoR. We provide SaaS companies with an all-in-one billing solution that integrates effortlessly with a wide range of systems. Plus, Paddle makes it easy to export customer data and subscriptions.

Before committing, consider how well a solution will work with your software stack. Can it accommodate your billing preferences without a lot of customization?

Scalability

As your business grows, your payment needs will evolve. Choose an MoR that can scale with you, expanding to new markets, integrating with your existing systems, and accommodating new payment methods as necessary.

Customer support and service level

From time to time, issues crop up when dealing with global payments and compliance. Look for an MoR that offers strong customer support, ideally 24/7, to help resolve problems quickly and efficiently.

Providing reliable support means a better experience for you and your customers.

Experience and reputation

Lastly, look at the MoR’s track record. Have they worked with companies similar to yours? Look for testimonials, reviews, and case studies to ensure they can deliver reliable service and address industry-specific challenges.

Wrapping Up

A Merchant of Record is more than just a financial service provider—it’s your partner in managing the complexities of global payments, compliance, and customer relations. From simplifying tax compliance to streamlining payment processing, an MoR allows you to focus on what really matters: growing your business.

Boathouse simplifies billing and payments for SaaS companies, providing a customer portal that works seamlessly with Paddle.

Arrange a demo today and find out how we can help you scale your operations.