We Share 5 Best Alternatives to Stripe for Payment Processing

Table of contents

Quick Summary

This article explores five alternatives to Stripe for payment processing, each offering a range of features that could better suit your business needs. From managing subscriptions and international transactions to providing customizable payment options and handling tax compliance, these alternatives offer flexibility and support.

Looking For The Best Alternative to Stripe for Your Business?

Is Stripe really the best fit for your business? With a 21% share of the global payment processing market, it’s undeniably a popular choice. Many businesses use Stripe because it’s known for its ease of integration, especially with developer-friendly APIs, making it a go-to for startups and large companies alike.

Popularity doesn’t always mean it’s the perfect fit though.

Payment handling plays a vital role in ecommerce, guaranteeing transactions move quickly, securely and without hiccups. Stripe, for instance, excels in providing customizable payment solutions for online businesses. Yet, while Stripe has many strengths, it might not be the perfect choice depending on your specific needs. Exploring other options could unlock better pricing models, enhanced support or a more customized payment experience.

The right payment solution can make all the difference, from lowering fees to improving customer satisfaction. In contrast, the wrong choice can add unnecessary cost or complexity, especially for businesses that need to set clean prices for international markets or provide subscription billing.

In this article from Boathouse, we cover five alternatives to Stripe you should consider. Each option offers unique features, pricing models and benefits which could better suit your payment needs.

Why Listen to Us?

What is Stripe?

Founded in 2010, Stripe has grown into one of the most widely used online payment processors globally. Known for its developer-friendly APIs, Stripe allows businesses to customize their payment solutions making it a popular choice for ecommerce stores, subscription services and marketplaces.

The platform supports payments via credit cards, debit cards and digital wallets such as Apple Pay and Google Pay in over 135 currencies, making it suitable for businesses looking to expand globally.

Many companies rely on Stripe for various financial operations such as billing, invoicing, and fraud prevention.

Why Choose a Stripe Alternative?

While Stripe is popular, it isn't perfect for every business. Here’s what some users from G2 and Capterra have to say about the platform:

High transaction fees

Stripe charges 2.9% plus $0.30 per successful card transaction, with an additional 1% fee for international cards and currency conversions. These fees can add up quickly, especially for businesses operating at scale.

Limited advanced customization options

Some users find Stripe’s tools restrictive when it comes to certain types of customization. For instance, companies that need more tailored checkout processes or advanced integrations might find that Stripe’s options don’t meet their needs.

Time consuming setup for non-developers

While Stripe is highly customizable, its API is designed for developers. For businesses without dedicated development teams, setting up Stripe and getting it to work efficiently can be a time-consuming process. Many companies also find they need to invest in additional tools for tax compliance or subscription management.

Customer support limitations

Some users have reported challenges with Stripe’s customer support, particularly when dealing with urgent issues. Alternatives that offer more hands-on support or quicker response times can be appealing for businesses that need real-time assistance.

Given these drawbacks, it’s worth considering other payment processors that might offer better pricing, more customization options or simpler integration processes.

Top 5 Stripe Alternatives

Here are our favorite Stripe alternatives, each bringing unique features and benefits. Before we get started, let’s take a look at the platforms we’ll be covering:

- Paddle (+ Boathouse)

- PayPal

- Square

- Adyen

- ChargeBee

Paddle

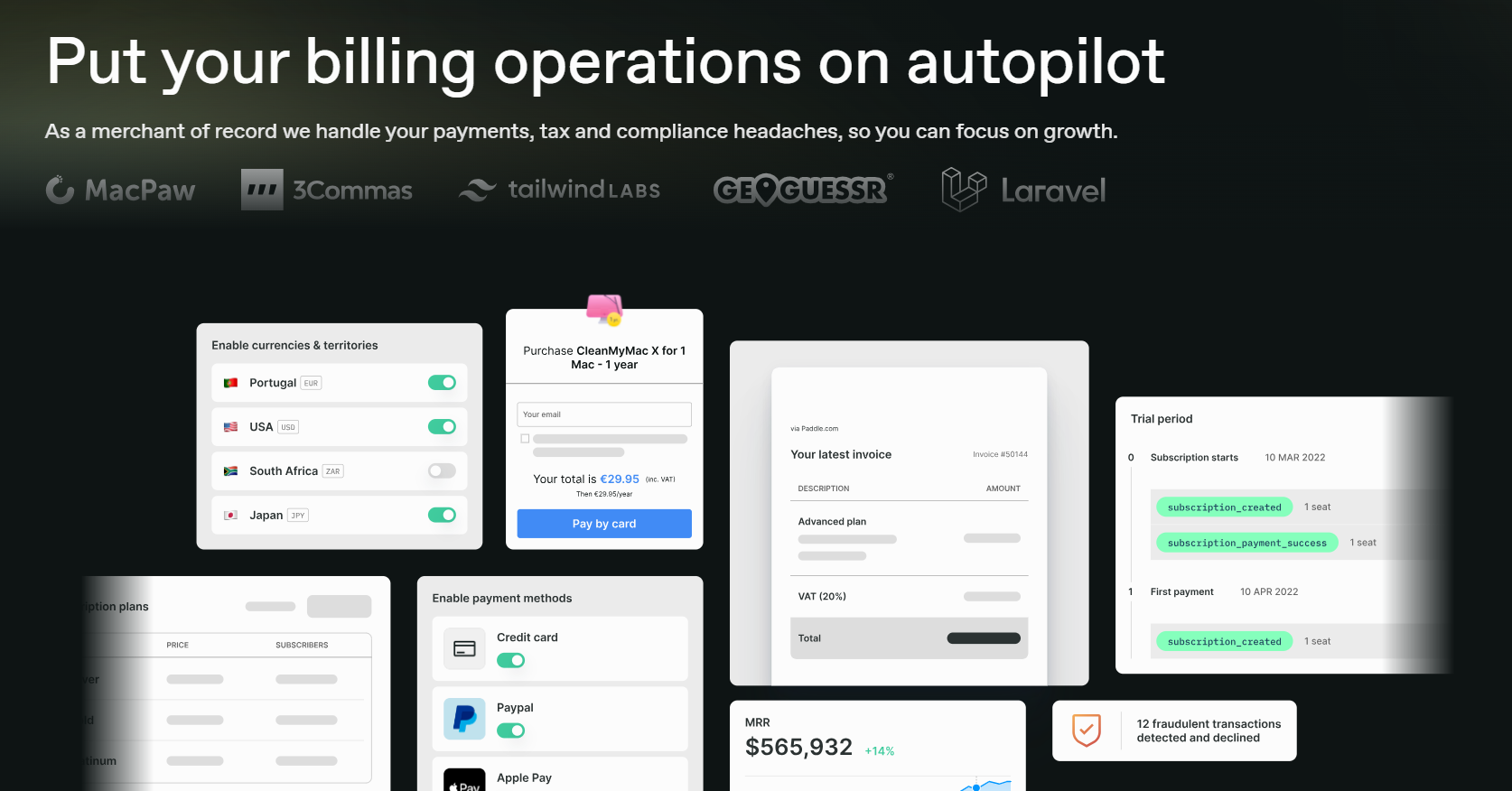

Paddle is a top choice for SaaS companies looking for an all-in-one payment processing solution. Unlike Stripe, Paddle acts as a Merchant of Record (MoR), handling all legal responsibilities related to transactions, including sales tax and VAT compliance.

With its ability to handle complex tax and regulatory requirements, Paddle is a great choice for businesses selling internationally.

Key Features

- Subscription management: Paddle provides tools for handling recurring billing, automatic renewal reminders, and free trials, catering to B2B and B2C subscription models.

- Built-in sales tax compliance: Ensures automatic compliance with sales tax regulations across Europe, the US, Canada, and Australia, reducing your operational burden.

- Comprehensive billing solutions: Paddle offers an all-in-one system for managing subscriptions, invoicing, and payments, simplifying your billing processes.

- License management: Paddle also streamlines license management for software products, so handling transactions and product access is a breeze.

- Analytics: Delivers insights into user behavior tracking metrics such as app usage, trial conversion rates, and customer engagement, helping businesses optimize their features.

Pricing

Paddle offers two pricing models—a pay-as-you-go plan at 5% + 50¢ per transaction, that covers global payments and tax compliance. For larger businesses custom pricing is available, which includes premium services like migration and implementation support.

Pros & Cons

Pros and cons gathered from G2:

Pros

- Streamlines tax and compliance for SaaS businesses

- Easy to set up

- Pricing is transparent, with no hidden fees

- Customer support is responsive

- Provides a comprehensive payment solution

Cons

- The flat 50¢ fee per transaction can be costly for smaller purchases

- Some API features are limited

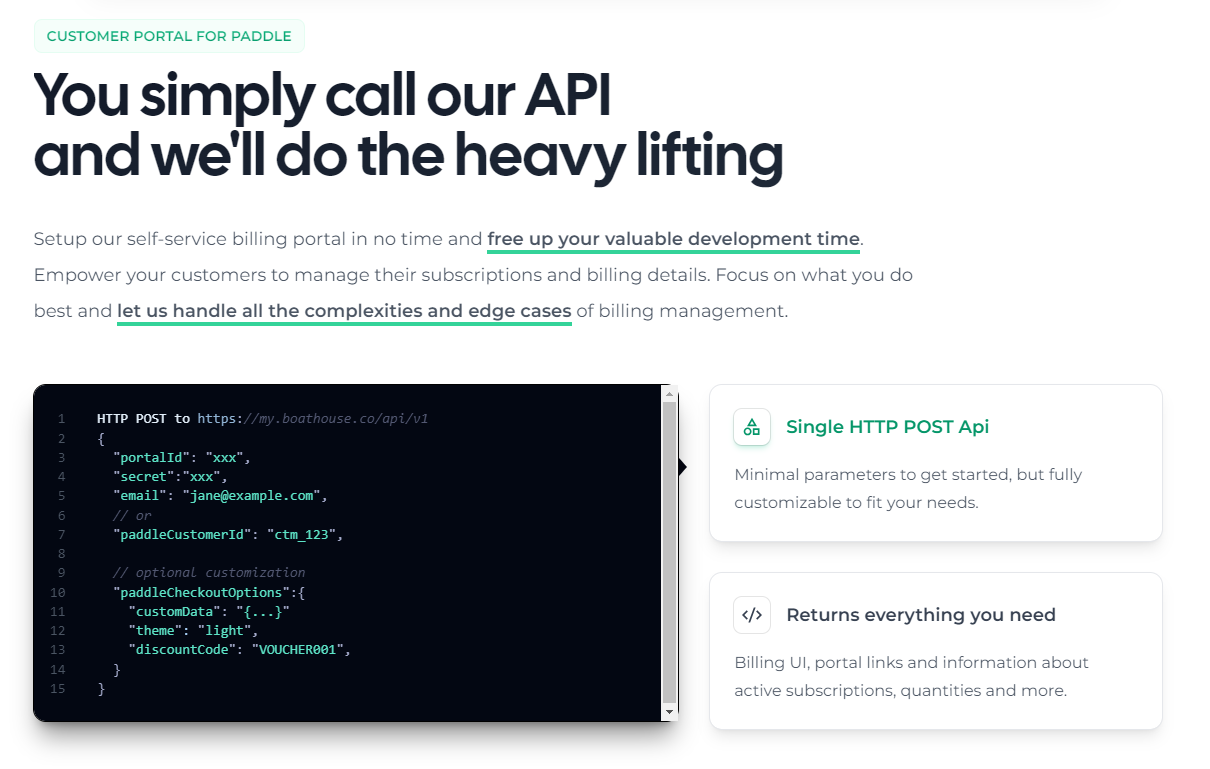

Why Boathouse Is the Best for Paddle Billing

Boathouse integrates with Paddle, simplifying subscription management and enhancing the overall customer billing experience. With features like embeddable pricing tables and customizable cancellation flows, Boathouse is an excellent complement to Paddle for SaaS companies looking to optimize their billing process.

Built by customer billing experts, Boathouse enables users to effortlessly update payment details, view transaction history and manage subscriptions—all from one place.

Optimized for SaaS businesses, Boathouse provides ready-to-go settings with support for 20 languages. With secure data handling within Paddle and no vendor lock-in, it’s a flexible solution for your billing needs.

Key Features

- Customizable self-service billing portal: Enables SaaS businesses to provide branded, self-service customer portals for managing their subscriptions.

- Embeddable pricing tables: Easily add pricing tables to your website, offering a smooth and integrated user experience.

- Customizable cancellation flows with feedback: Allows businesses to gather valuable customer feedback through a personalized cancellation process.

- Branded billing emails: Send customized billing emails to keep customers informed and aligned with your brand.

- Automated drip campaigns: Engage customers through automated email sequences to boost retention.

- Simple API integration: Quick and easy setup through simple Boathouse API.

Pricing

Boathouse offers a Basic plan, free for businesses with up to £500 MRR, and includes core features like the Customer Portal. For companies with higher MRR, Pro pricing plans range from £17 to £67 per month, depending on revenue, and include full features.

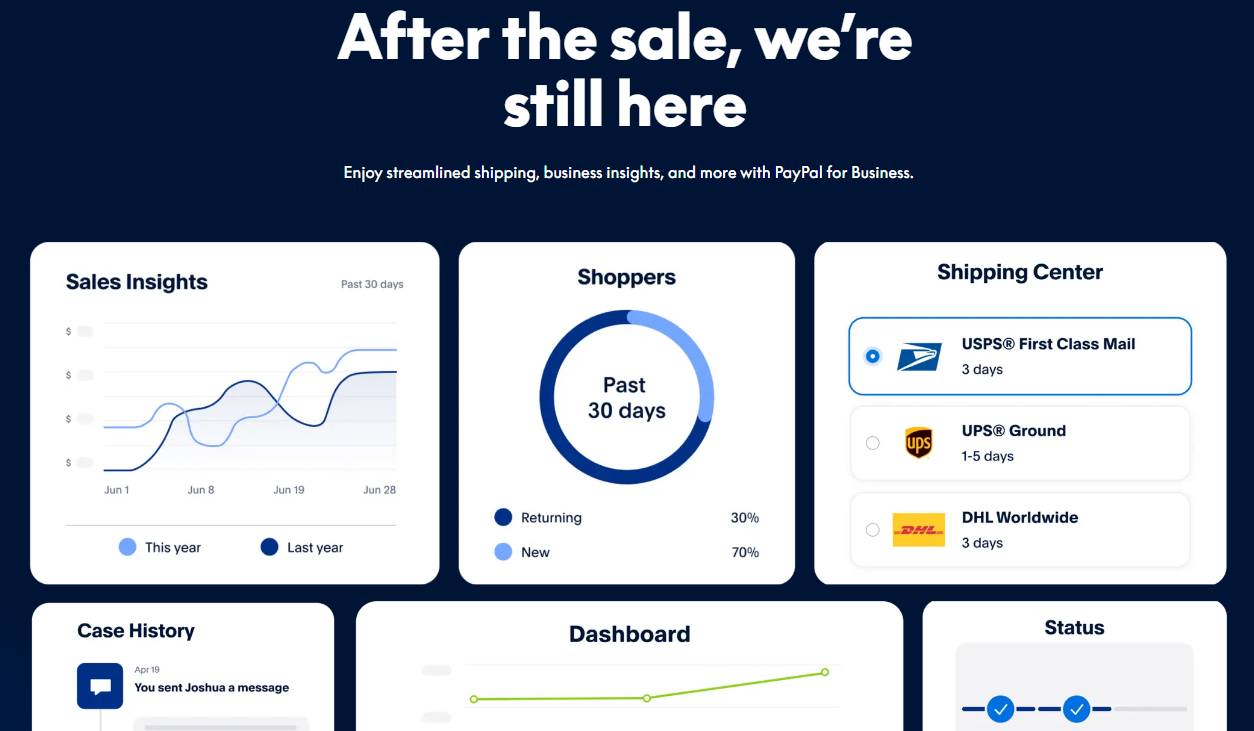

PayPal

PayPal is one of the most well-known payment processors, with a long history of supporting both online and in-person transactions. PayPal offers a range of services, from simple payment buttons to full-scale merchant services. It’s widely trusted and accepted in over 200 countries, making it a solid choice for businesses with international customers.

Key Features

- Broad integration: PayPal integrates easily with most online platforms. Many e-commerce sites offer one-click setup—simply add your account details.

- Global availability: Operates in over 200 countries. PayPal is suitable for SaaS businesses with an international customer base.

- Buy now, pay later (BNPL): PayPal offers a native BNPL option, allowing customers to split payments without needing third-party apps.

- Cryptocurrency support: One of the few platforms with cryptocurrency payment processing, making it a great option for businesses looking to accept digital currencies.

Pricing

PayPal charges a standard fee of 2.9% + 30¢ per domestic transaction. For international transactions, an additional 1.5% fee applies. Businesses may also face conversion fees when handling foreign currencies, which can add up with a high volume of orders.

Pros & Cons

Pros and cons gathered from G2:

Pros

- Available in 200+ countries and supports multiple currencies

- Simple integration and a user-friendly interface

- Recognized and trusted worldwide

- Offers fraud protection and encryption

Cons

- High transaction fees

- Withdrawals or transfers may take several days to complete

- Outdated dashboard

Square

Square is known for its user-friendly interface and omnichannel payment solutions. It tracks live sales and inventory helping businesses monitor payments, stock levels, and sales, making it a good solution for businesses that operate both online and in physical locations. Square also simplifies financial management via multiple payment options, and drag-and-drop features on the dashboard make pulling reports easy.

Key Features

- Real-time invoice tracking: Provides live reporting and analytics to keep you updated on payments.

- Digital receipts and inventory management: Includes daily stock updates for better inventory control.

- Omnichannel payment solution: Square’s online and in-store systems sync effortlessly, allowing businesses to track sales, inventory and transactions across all channels.

- Scalable tools: Square offers add-ons for growing businesses, such as invoicing, virtual terminals, social selling, team management and loyalty programs.

Pricing

Square charges 2.6% + 10¢ per transaction for card payments in-person, and 2.9% + 30¢ for online transactions. Additional features like invoicing are free to use.

Pros & Cons

Pros and cons gathered from G2:

Pros

- Supports multiple payment options

- Good customer support and responsive assistance

- No monthly fees and low payment processing fees

- Extensive integrations

Cons

- Delays in transferring funds

- Some features require additional fees

- Limited customization for advanced reporting

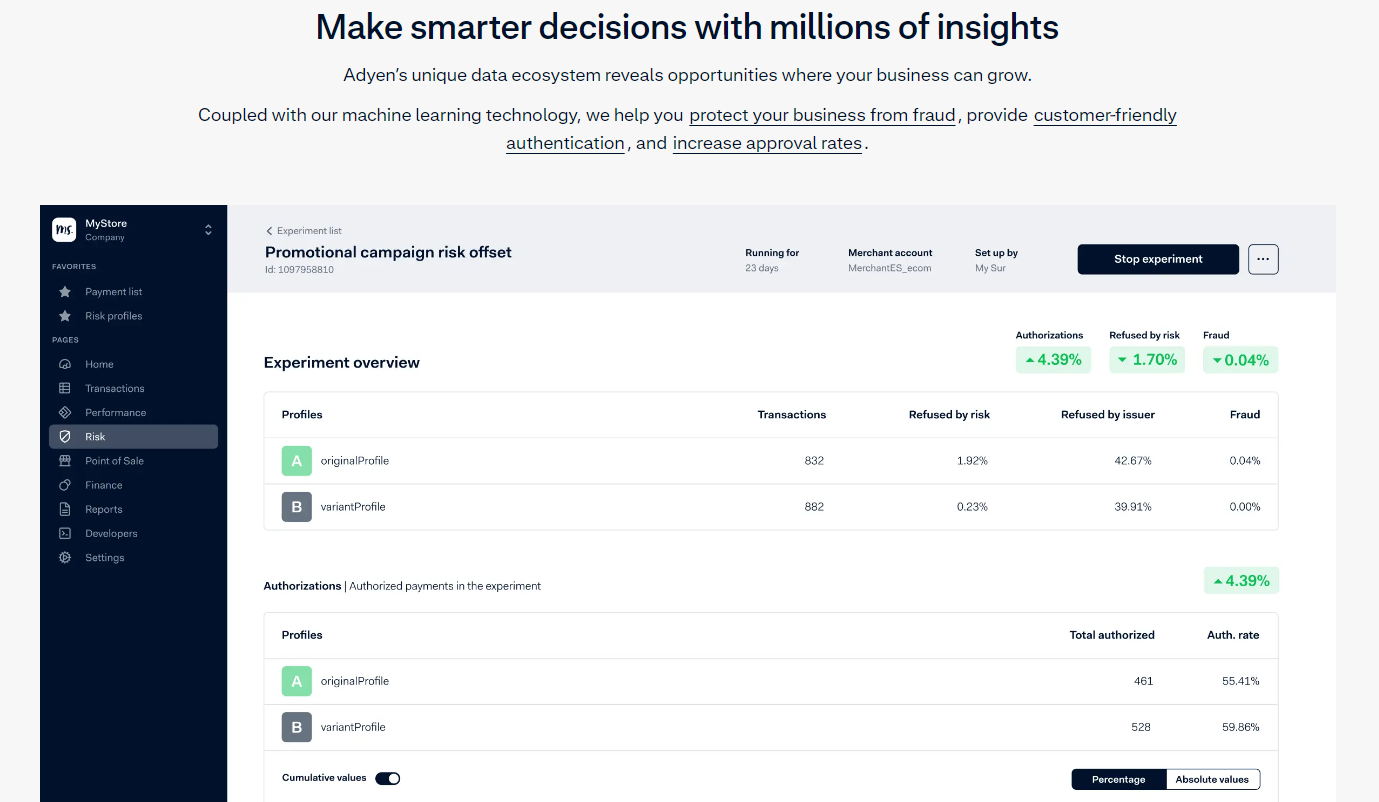

Adyen

Adyen is a strong contender for businesses with high transaction volumes. It’s a payment processing platform that serves large enterprises and offers a centralized solution for managing ecommerce sales, in-store transactions and online payments. Adyen’s real-time data and analytics features make it a powerful tool for businesses that need advanced reporting.

Key Features

- Centralized platform: Allows businesses to manage all ecommerce sales from one platform, with built-in analytics for data-driven decision-making.

- Omnichannel sales: Create seamless customer journeys across multiple sales channels and integrate payments directly into your marketplace.

- Revenue optimization: Boost authorization rates and increase conversions to maximize revenue.

- Merchant account: Provides customizable online payments with risk management and transaction optimization.

Pricing

The pricing is quote-based. Adyen typically charges an interchange fee and processing fee, making it more suitable for larger businesses with high transaction volumes.

Pros & Cons

Pros and cons gathered from G2:

Pros

- Simple and easy-to-use interface

- Versatile payment options

- Good transaction visibility

- Quick onboarding process

Cons

- Complex pricing structure

- Fund transfers can be slow

- Some features require expert knowledge

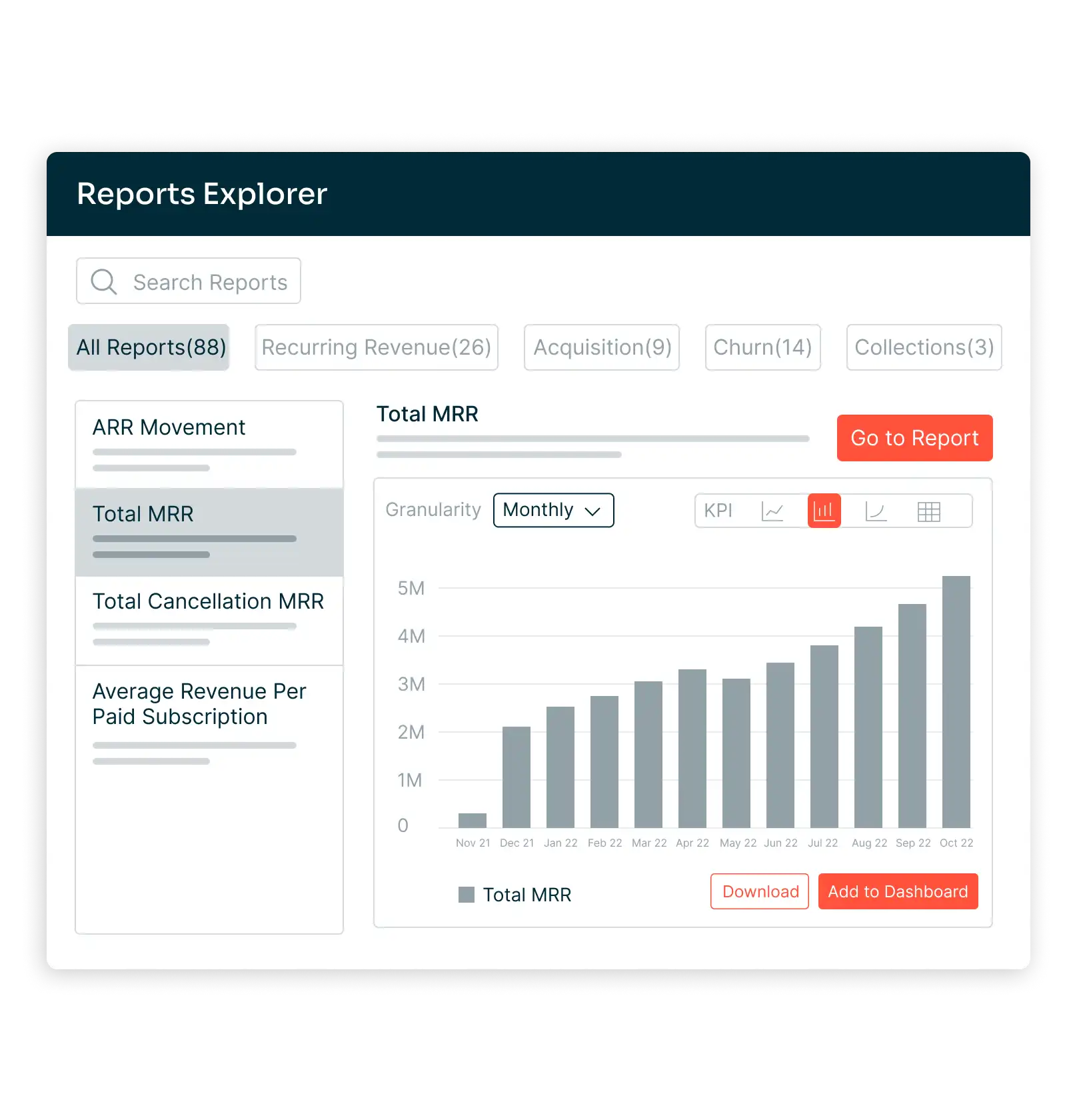

Chargebee

Chargebee is a subscription management platform designed for businesses that rely on recurring and usage-based billing models. Chargebee is cloud-based and integrates easily with a wide range of payment processors, including Stripe, PayPal, and Adyen, giving businesses flexibility in choosing the right payment gateway for their needs.

Key Features

- Automated billing: Helps to streamline billing processes.

- Trial management: Provides tools for managing trial periods efficiently.

- Workflow automation: Automates payment collection, discount management and invoice generation.

- Self-service portals: Allows customers to manage their subscriptions independently reducing pressure on customer service departments.

Pricing

Chargebee offers tiered plans. The Launch plan is free for up to 3 users, the Rise plan is $249/month for small businesses, and the Scale plan is $549/month for fast-growing startups. Custom pricing is available for large enterprises.

Pros & Cons

Pros and cons gathered from G2:

Pros

- Responsive and helpful customer support

- User-friendly API for real-time data synchronization

- Intuitive user interface for managing payments

Cons

- Lack of detailed installation documentation

- The onboarding process boasts a steep learning curve

- Some technical limitations

Criteria to Consider When Choosing a Stripe Alternative

When selecting a payment processor, there are several key factors to consider that will make a big difference in day to day operations. Here’s what you should keep in mind when considering a Stripe alternative:

- Pricing and fees: Look for a provider with transparent pricing and lower transaction fees, especially if you process a high volume of payments or handle international transactions. For more information, check out our article “Setting clean prices for international markets using Paddle.”

- Ease of integration: Pay attention to how easy it is to integrate the payment processor into your existing systems. Developer-friendly APIs or no-code options can make integration smoother, whether you have a dedicated development team or not.

- Customization options: Flexibility is key. Ensure the platform offers options to tailor your checkout optimization, pricing structures and integrations to fit your business model.

- Payment methods and currencies: If your business operates internationally, choose a processor that supports a variety of payment methods (credit cards, digital wallets, etc.), localized prices, and multiple currencies—especially if you offer international support.

- Recurring billing and subscription management: For businesses with subscription models, it's important the processor can manage recurring payments efficiently. Look for features like subscription tier management, automatic renewals and tools to manage cancellations and upgrades.

Speaking of subscription management, Boathouse connects flawlessly with Paddle, so managing SaaS subscription billing practices is super easy—whether it’s updating payment information or changing subscription tiers.

Wrapping Up

Stripe is a popular payment processor, but it’s not the only option out there. Each of the alternatives covered in this article offers unique advantages, from lower fees to more comprehensive subscription management tools. Depending on your business’s needs, one of these alternatives might offer a better fit, whether that’s Paddle for SaaS companies, PayPal for international reach, or Square for omnichannel sales.

For SaaS businesses using Paddle, Boathouse is a must-have. Our customer billing portal takes the stress out of subscription management, offering seamless integration and a streamlined user experience. Whether you’re dealing with global payments, tax compliance, or customer retention, Boathouse makes it easier to manage your billing process.

Ready to take your payment processing to the next level? Arrange a demo today and see how Boathouse can help.